Listed below are several often discussed market opportunities and some of the related information on growth aspects relative to MIM and its future.

Consumer, cell phone, and computer uses continue to grow. A comparison of the 2007 and 2009 partition shows an increased use of MIM in hand-held devices, ranging from cell phones to portable computers. The components are small, complex, and strong, applied to switches, buttons, hinges, latches, and decorative devices. Since most of the assembly is in Asia, parts production has migrated to Asia to keep supply lines short.

Firearms went through a rapid escalation after the November 2008 election of Obama to the Presidency in the USA, due to fear of new restrictive gun laws; although that wave passed in North America, the temporary surge offset the economic decline seen in many other fields. Military procurement of firearm components has started to slow. However, smaller firearm manufacturers have started to embrace MIM.

Industrial, hand tool, and household applications remain strong and steady, and include valve, plumbing, spraying, wrenches, multitools, pepper grinders, scissors, circular saws, nailing guns, and similar devices.

Automotive applications for MIM started to escalate with use in turbochargers, fuel injectors, control components (clock mounts, entry locks, knobs, and levers), and valve lifters.This initiated in the USA for Buick and Chrysler applications, but leadership shifted to Japan with Honda and Toyota applications from integrated vendors (Nippon Piston Rings) for turbocharger and valve applications. Subsequently, European MIM shops picked up on the materials and applications opened by higher performance but smaller engines, and this wave has become global. There are many complaints over automotive parts production, but it generates large sales volumes that help to lower all costs and improve the field. All expectations are that MIM will continue to grow in the automotive sector.

Medical applications are growing from an early base of endoscopic devices, and will become enormous as MIM becomes widely accepted.

MIM. However, pricing allows for sales that might reach $4 million per design. So far only a few MIM firms are positioning for the production of implants, while many are seeking orders in surgical hand tools. Minimally invasive surgical tools are a prime opportunity for MIM. Micro-featured devices are frequently shown for new genetic sensors (micro-pillar, micro-texture, and micro-array designs). These will be small devices, potentially used in enormous quantities for rapid blood testing and disease identification.

Dental applications in this field long ago matured and today there are several firms involved in orthodontic bracket fabrication. However, new instrument and hand tool designs have opened up special opportunities for micro-featured designs. So MIM is moving from its strong historical position in orthodontic brackets into hand tools and special endodontic surgical devices.

Aerospace applications for MIM have been demonstrated for 30 years. A new wave of efforts is now starting, driven by cost concerns and envisioned savings with MIM. About a dozen firms are active in this area. Like medical applications, the production volumes are often small, in the 10,000 per year range, but the unit prices are high.

Lighting applications for MIM are limited to refractory metals and ceramics, and the developments in this area are in the hands of the big three—Sylvania, Philips, and General Electric. After much early effort, the MIM viability is in serious doubt due to cost reduction and competing light-emitting diode (LED) devices. Mounts for LED devices out of copper by MIM have been displayed, but cost will probably work against MIM.

Sporting applications have persisted for 20 years, but it appears the cost points in this field do not match well with MIM and the penetration of MIM remains small. Past successes have included metal supports for football knee braces, dart bodies, golf clubs, and running cleats.

Jewelry applications are new to MIM and could potentially grow rapidly as alternative materials (nongold and nonsilver) become accepted. These include titanium, high-polish stainless steel, tantalum, and even bronze.

The upside market size on a few of these is quite large, while others not listed above might grow, but the key actors are in place in Asia and it is doubtful if new entries can play a role.

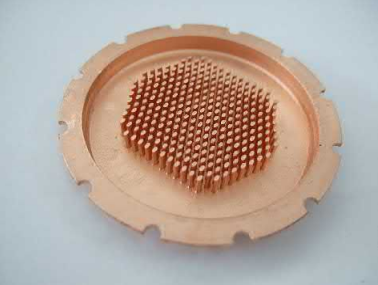

Future opportunities emerging from research and development (R&D) efforts are discussed at the conferences. Some of the leading opportunities include ultra-highthermal conductivity composites (for example copper-diamond) for heat sinks. Demonstrations reaching 580W/(mK) thermal conductivity have been shown by a Japanese MIM firm for use in supercomputers, high-end servers, phased array radar systems, military electronics, hybrid vehicle control systems, gaming computers, and other applications involving high-performance computing. One such device is pictured in Fig. 1.4.

A related area is in vapor chamber designs, typically from copper, where a closed internal chamber of porous metal is used to apply heat pipe technology to a similar problem requiring heat dissipation around electronics.

Similarly, another area is LED heat sinks, where copper arrays are used to mount the semiconductor, with reports of 100 g arrays with costs as low as $0.75 per mount; these demonstrations have largely come from Asia.

Fig. 1.4 A copper MIM heat transfer device used for electronic cooling. Photograph courtesy of Lye King Tan.

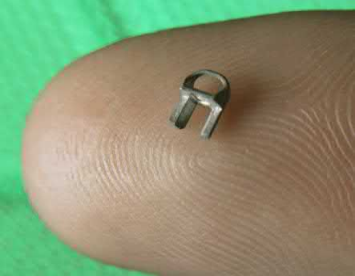

Fig. 1.5 Stainless steel MIM medical implant device

Microminiature MIM for medical minimally invasive surgical tools is an area of development, involving very small components for end manipulators, such as cutters, grasps, and drug delivery. Most are made from stainless steel and example components are being sold in the range of $2–$15 each. Fig. 1.5 shows one example used in shoulder repair.

Other microminiature MIM applications involve components for cell phones, computers, hand-held electronic devices, and dental hand tools for endodontic use and dental cleaning. Implants such as dental tooth posts, components for ligament alignment, hearing canal (ear) reconstruction, drug delivery, heart valves, artificial knees, shoulders, and hips, are expected to be a billion dollar opportunity, but will require considerable dedication and resources to realize; Stryker and Medtronic have set up internal production, Zimmer and Biomed have elected to work with a few MIM shops, and Accellent has elected to be fully qualified for any applications on a custom basis.

Microarray devices with hundreds to thousands of pins, posts, or holes for disposable lab-on-a-chip devices are used in blood testing, assessment of disease, analysis of DNA to predict disease, and protein tests; the biochip market is targeted to reach $3.8 billion in sales by 2013 and considerable research is taking place to support this effort. Hewlett-Packard and Oregon State University have a small MIM facility examining options, but activity is also on-going in Germany, Singapore, and Japan.

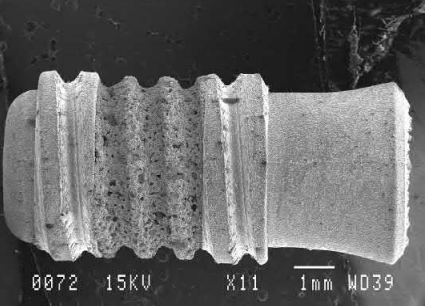

Titanium biocompatible structures, such as for tissue affixation, implants, surgical tools, tool implants, and even sporting devices represent another development area. About 19 firms have some variant of titanium, but few have focused on medical quality. Porous titanium by MIM offers the possibility of hydroxyapatite (bone) infusion; an example MIM device for tooth implants is shown in Fig. 1.6.

Fig. 1.6 Titanium dental implant formed by MIM with an intentional porous region for bone ingrowth

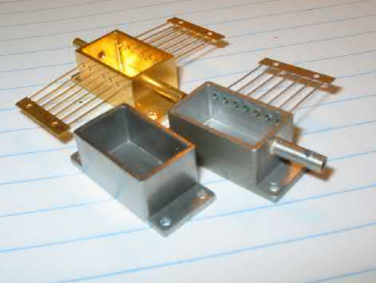

A further example is hardware tools from tool steel, such as threading devices for cast iron plumbing or water pipes, hand tools, valves and fittings, handles, forming tools, drills, dies. Also, hermetic packages for microelectronics are being developed using Kovar to enable glass to metal sealing. Fig. 1.7 shows an example MIM part that is sealed with lead. This design routinely sells for $30 each.

Fig. 1.7 Hermetic Kovar microelectronic package with attached glass-metal sealed lead wires

Aerospace applications exist for smaller superalloy bodies such as IN 625, 713, 718, 723, or Hastelloy X, where the high detail, good surface finish, and shape complexity offered are financially attractive for military and commercial applications. Polymer Technologies, Maetta Sciences, PCC Advanced Forming, Parmatech, Advanced Materials Technology, Advanced Powder Processing, and a few other firms are positioned for this area.

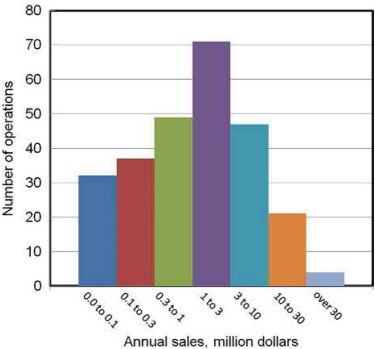

Of that total population of companies, the majority practice MIM. The distribution in annual sales for the 366 PIM firms is given in Fig. 1.8. This plot shows almost half are small, with under $1 million in annual sales. This is a partitioning that is roughly based on a factor of three step size, starting with 100,000 for the smaller firms and increasing to show five PIM firms over $30 million.

Fig. 1.8 Sales distribution chart for global MIM firms, showing the mode size is in the range from $1 million to $3 million annual sales and over half the firms are below $1 million in annual sales.

The statistics show that MIM is at an early stage of sophistication as a net-shaping technology. The North American segment is about 90% fully in compliance with one of the ISO 9000/9001/9002 variants, about 25% incompliance with ISO 14000, but nearly 60% of the companies have no intentions along these lines. Several of the firms are into the automotive standards, but few are certified with AS 9100 B, which is required for aerospace components—Maetta Sciences, Pratt and Whitney, Polymer Technology, and PCC Advanced Forming Technology. Several of the firms are in compliance with the ISO 13485 good manufacturing practices required for medical devices, but only a few are at the standards required for implants.

Another view of the sophistication is evident by the sales distribution, where the top 10% of the firms based on annual sales control about 60% of the sales, show higher sales per full-time employee (slightly under $300,000/FTE), per molding machine ($1.5 million), per furnace ($3.2 million), and generally set the benchmark for productivity. On the other hand, 50% of the firms listed in this report have annual sales of $1 million or less, and drag down all of the industry statistics.

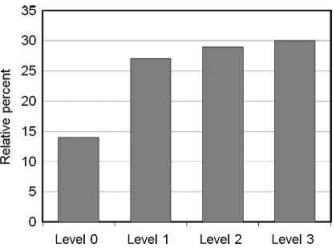

The key actors in MIM are small compared with several other metalworking technologies. The sophistication of the PIM industry is graphically given in Fig. 1.9. The stage 0 firms are in an evaluation mode, largely trying to determine if there is a business fit, for example possibly a plastic molder seeking material diversification. The stage 1 operation would have no serious sales, and might be setting up or shutting down or sitting idle with technology. A significant portion of the MIM industry is in this situation. A few will grow to be significant actors. Others have dabbled for many years, but have never found the right combination of customers and technology. There are about 150 firms showing up in MIM that fit this category and they contribute about $42 million in sales (roughly $0.25 million per firm per year).

Fig. 1.9 A histogram plot showing the relative sophistication of the MIM industry based on operational characteristics, as described in the text.

Stage 2 firms are more serious about making a business and generally are operating with several molders and are pushing to grow their business. This group generally is between one and two shifts and consists of slightly over 100 firms doing about $116 million in sales.

The stage 3 firms dominate the sales, consisting of slightly more than 100 firms doing just under $700 million in sales ($7 million per firm). These are the captive operations in dental and firearms and the major custom.

Most of the stage 2 firms are qualified by ISO audits, but only the larger firms are in compliance with aerospace, automotive, or medical quality standards.

The PIM field has exhibited enormous growth since the first sales statistics were gathered in 1986, amounting to $9 million globally then. Today, MIM is the dominant form of PIM and has sustained 14% per year growth in recent years. The number of MIM firms has not shown much change in recent times, but the size and sophistication have grown considerably. Various estimates have been offered for how far and how long MIM can sustain the growth. The informed estimates balance cost, capacity, and competitive factors, but generally agree that MIM will double yet again to reach $2 billion in annual sales by 2017. After that, significant cost reduction will be required. Unfortunately, industry-wide research and innovations seem to be lacking. The R&D personnel, publication rate, patent rate, and other leading indicators warn that MIM reached its peak of innovation in about 2005. Contemporary concepts show that patent activity is generally the best leading indicator of commercial sales and profits; so, on this basis, there are early warnings of MIM reaching the end of its growth. Another symptom of the end of growth comes from the fact that, rather than innovation, most industry R&D efforts have turned to cost reductions, improved quality, improved dimensional control, and improved impurity control. These shorter-term gains will not offset the longer-term needs for new materials, products, and applications as required to sustain MIM toward $2 billion in annual sales.

Contact: Cindy Wang

Phone: +86 19916725892

Tel: 0512-55128901

Email: [email protected]

Add: No.6 Huxiang Road, Kunshan development Zone, JiangsuShanghai Branch: No. 398 Guiyang Rd, Yangpu District, Shanghai, China