Powder injection molding (PIM) has a main subdivision, metal powder injection molding (MIM), that has penetrated many fields. This chapter captures the status of the MIM field and provides a basis for evaluating different operations, markets, and regions. Like powder metallurgy, MIM relies on shaping metal particles and subsequently sintering those particles. The final product is nearly full density, unlike press-sinter powder metallurgy. Hence, MIM products are competitive with most other metal component fabrication routes, and especially are successful in delivering higher strength compared with die casting, improved tolerances compared with investment or sand casting, and more shape complexity compared with most other forming routes. Injection molding enables shape complexity, high-production quantities, excellent performance, and often is lower in cost with respect to the competition. Its origin traces to first demonstrations in the 1930s. In the metallic variant, most of the growth has been after 1990, when profitable operations began to emerge following several years of incubation.

Sintered materials technologies (cemented carbides, refractory ceramics, powder metallurgy, white wares, sintered abrasives, refractory metals, and electronic ceramics) add up to a very large value, with final products reaching $100 billion per year on a global basis. About 25% of that global activity is in North America.

The production of metal powders alone in North America is annually valued at $4 billion (including paint pigments, metallic inks, welding electrodes, and other uses, besides sintered bodies). Sintered carbide and metal parts production in North America is valued at near $8 billion, where metal-bonded diamond cutting tools, sintered magnets, and semimetal products contribute significantly to industry heavily focused on automotive and consumer products.

The powder metallurgy industry consists of about 4700 production sites around the world involved in variants of powder or component production. Most popular is the press-sinter variant that relies on hard tooling, uniaxial compaction, and hightemperature sintering. Based on tonnage, about 70% of the press-sinter products are for the automotive industry. However, on a value basis, the story is dramatically different; metal cutting and refractory metal industries generate the largest value. Here, the products include tantalum capacitors, tungsten light bulb filaments, tungsten carbide metal cutting inserts, diamond-coated oil and gas well drilling tips, high-performance tool steels, and molybdenum diode heat sinks. Compared to the other powder technologies, the MIM variant is still relatively new and small, but it is growing at 14% per year. In 2011, MIM products were globally valued at approximately $1 billion. This sales activity is spread over about 300 actors. Thus, the average sales would be just $3 million per year for a MIM firm.

PIM followed behind the first developments in plastic injection molding. Early polymers were thermosetting compounds; Bakelite, the first man-made polymer, was invented about 1909. Subsequently, as thermoplastic such as polyethylene and polypropylene emerged, forming machines appeared to facilitate the shaping of these polymers a few years later. The first demonstrations of PIM were nearly coincidental with the emergence of plastic injection molding. Simultaneously in the USA and Germany during the 1930s, this was applied to the production of ceramic spark plug bodies. This was followed by the use of PIM for forming tableware in the early 1960s. Generally, these were components with wide allowed dimensional variation. The MIM variant reached production in the 1970s. The time delay between early demonstration and commercialization was due to a lack of sophistication in the process equipment. The manufacturing infrastructure improved dramatically with the advent of microprocessor-controlled processing equipment, such as molders and sintering furnaces, which enabled repeatable and defect-free cycles with tighter tolerances.

About 80% of the PIM production capacity is devoted to metals, recognized as MIM, but this generally does not include other metal molding technologies such as die casting, thixomolding, and rheocasting. The first MIM patent was by Ron Rivers (Rivers), using a cellulose-water-glycerin binder that proved unsuccessful. Subsequent efforts with thermoplastic, wax-based binders did reach production at several sites.

Major attention was attracted when MIM won two design awards in 1979. One award was for a screw seal used on a Boeing jetliner. The second award was for a niobium alloy thrust-chamber and injector for a liquid-propellant rocket engine developed under an Air Force contract for Rocketdyne. Several patents emerged, and one of the most useful was issued in 1980 to Ray Wiech. From this beginning, a host of other patents, applications, and firms arose, with special activity in California. By the middle 1980s, the technology landscape showed multiple actors. Many companies set up at this time without a license, simply by hiring former employees from the early firms who brought with them insight into the technology.

All of the early binder patents have expired and the wax-polymer system discovered by Ray Wiech remains the mainstay of the industry. Since the mid-1990s, the use of paraffin wax has migrated to variants such as polyethylene glycol to give water solubility to part of the binder system. This has improved the concerns over solvents used to remove the binder from the molded component—simply immerse the shaped component in hot water to dissolve out most of the binder.

Thus, the MIM concept relies on plastic molding technology to shape a powderpolymer feedstock into the desired shape. The shape is oversized to accommodate shrinkage during sintering. After molding, the polymer is removed and the particles densified by high-temperature sintering. The product is a shrunken version of the molded shape, with near full density, and performance attributes that rival handbook values, usually far superior to that encountered in traditional press-sinter powder metallurgy and investment casting. This success is widely employed in small, complex, and high-value components, ranging from automotive fuel injectors to watch cases.

The MIM industry structure and interactions shows generally that the firms fall into a few key focal points. Everything revolves around the custom fabricators, firms that form components to satisfy the specifications of the user community—the users are generally well-known firms such as in firearms (Glock, Colt, Remington), computers (Hewlett Packard, Dell, Apple, Seagate), cellular telephones (Motorola, Samsung, Apple), hand tools (Sears, Leatherman, Snap-on Tools), industrial components (Swagelok, Pall, LG), and automotive (Mercedes-Benz, Borg-Warner, Honda, BMW, Toyota, Chrysler). The leading conference focused on MIM started in 1990 and continues today, where participants gather to share information on technology advances. At these conferences the actors in the industry generally come from one of the following sectors:

ingredient suppliers—polymers, powders, and ingredients for either selfmixing or commercial feedstock production; globally there are approximately 40 firms that provide most of the MIM powders, although about 400 firms supply metal powders of various chemistries, particle sizes, particle shapes, and purities; for example, in titanium about four companies out of 40 suppliers make the powders used for MIM;

feedstock production firms—purchase raw ingredients and formulate mixtures for sales to molding firms; globally there are usually about 12 feedstock suppliers;

molding firms—both custom and captive molders that total nearly 300 MIM operations; about one-third are captive and make parts for themselves, but many of the captive firms also perform custom fabrication; 83% of all parts production is categorized as custom manufacturing;

thermal processing firms—own sintering furnaces and debinding equipment that provide toll services; currently only a half-dozen firms are active in this area and most are associated with furnaces fabricators; a few firms provide toll hot isostatic pressing to force 100% density when required in medical or aerospace fields;

designers—largely systems design firms associated with large multinational firms that intersect with the MIM industry; a few independent designers are available to handle ad hoc projects;

equipment suppliers—firms that design and fabricate custom furnaces, molders, mixers, debinding systems, robotic systems, and other capital devices such as testing devices; the majority of molding machine sales are from six firms, furnace sales are from eight firms, mixer sales are from four firms, so about 20 firms constitute the key equipment suppliers;

consumables suppliers—supply process atmospheres, chemicals, molds, polishing compounds, machining inserts, packaging materials, heating elements, and sintering substrates;

adjuncts—including researchers, instructors, consultants, design advisors, conference organizers, trade association personnel, magazine editors, and patent attorneys.

Component production is the central activity. It is split between internal and external products, referred to as captive and custom molders. Likewise it is supported by two parallel supply routes, depending on the decision to selfmix or to purchase premixed feedstock. An example captive molder would be a firearm company that uses MIM to fabricate some of the safety, trigger, or sight components. On the other hand, custom molders also can make these same components, but just as likely may be involved in several application areas as determined by their customer base.

As outsourcing increases for multinational firms, custom fabrication grows. Accordingly, MIM from facilities owned by large firms such as Rocketdyne, IBM, AMP, and GTE as early adopters, shifted to purchasing components from captive molders focused on a variety of application areas. Some of the early captive applications included the following examples:

dental orthodontic brackets made out of stainless steel or cobalt-chromium alloys;

business machine components for postage meters and typewriters;

watch components including weights, bezels, cases, bands, and clasps;

camera components that included switches and buttons;

firearm steel parts such as trigger guards, sights, gun bodies, and safeties;

carbide and tool steel cutting tools such as wood router bits, end mills, and metal cutting inserts;

electronic packages for electronic systems using glass-metal sealing alloys;

personal care items such as hair trimmers using tool steel;

medical hand tools for special surgical operations;

rocket engines using specialty materials such as niobium;

automotive air bag actuator components using hardenable stainless steels;

special ammunition that included birdshot, armor piercing and frangible bullets;

turbocharger rotors for trucks and automobiles formed from high-temperature stainless steels or nickel superalloys.

Since each of these MIM operations had a single field of focus, little was done to grow that portion of the industry. However, in more recent years growth in MIM has come with the shift to custom molding which services a wide variety of applications. The custom molding firms have joined together in efforts to advance the industry, via collaborative marketing efforts, promotion of material standards, publicity through annual awards, and sharing of business data. Although declining, captive molding still remains an important part of the MIM industry. Although the sales growth varies year to year, in most recent times, the global sales gain has been sustained at 14% per year.

Measures of the MIM growth are possible through several parameters, including the following.

Patents: Since the start of MIM the total patent generation is large, exceeding 300 by the year 2000, but in more recent years the rate of patent generation has slowed and there are today about 200 currently active patents.

Powder sales: In 2010, more than 8000 tons of metal powder were consumed globally by MIM, with a growth rate in powder tonnage use approaching about 20% per year, but due to price reduction the value increases about 14% per year.

Feedstock purchase: The two options of self-mixing or purchasing feedstock seem to be of equal merit. Of the top firms, 71% form their own feedstock, which is almost the same ratio for all companies independent of size, suggesting purchased feedstock is neither an advantage nor disadvantage; however, self-mixing does provide greater manufacturing flexibility.

Mixing: For those firms mixing their own feedstock, in 2011, they generate $1.8 million in sales per mixer, but the top 20 firms that mix their own feedstock are at $7 million in sales per mixer per year.

Sales per molder: In many countries, especially when an operation is at a high utilization, the molding machine generates at least $1 million in sales per year. Across the industry the mean sales per molder is $536,000, while the leading firms have $1.5 million in sales per molder per year.

Sales per furnace: Furnaces come in many different sizes and designs, but across the industry sales average about $1 million per furnace per year; for the top MIM operations (with larger and continuous furnaces) the sales average $3.2 million per furnace per year.

Continuous furnaces: In 2011, the installed capacity of high-volume continuous sintering furnaces reached 4500 tons of products per year; these are installed with a breakdown of 38% Asia, 47% Europe, and 15% North America.

Captive versus custom production: About a third of the firms are captive, but only 21% of the firms have more than 50% of their sales internally. The best estimate is that 17% of the production value in 2011 is for internal use.

Sales per kg: Across the MIM industry the average is about $125 in sales per kg of powder consumed, ranging from highs of $10,000 per kg for jewelry, cutting tips, and precision wire bonding tools to $16 per kg for casting refractories. The largest ceramic application is in aerospace casting cores, and the typical is $1000 per kg. Likewise, for metals, the stainless steel orthodontic bracket contributes nearly $100 million in annual sales at an average near $650 per kg. The low tolerance tungsten cell phone eccentric weights sell for a very low price, in the $60 per kg range.

Sales per part: Across the industry, the typical part sale price is between $1 and $2 each, but values range from 5 cent cell phone vibrator weights to $35 solenoid bodies and $400 knee implants.

Component size: The most typical MIM part mass is in the 6–10 g range. The mass range is from below 0.02 g to over 300 g, but the mean is under 10 g. The largest MIM parts are heat dissipaters for the control systems in hybrid electric vehicles at 1.3 kg and some aerospace superalloy bodies that have similar mass and dimensions reach 200mm. A growing aspect of MIM is the microminiature components where features are in the micrometer range and this approached $68 million per year in sales for 2010.

Employment: Nearly 8000 people are employed in PIM globally, of which nearly 7000 people are employed in MIM, giving an average of 21 people per operation and a median of just 16 people per MIM facility. The larger firms reach upwards to 300–800 people; the largest ceramic injection molding firm once reached employment near 800 people.

Historically, about 80% of the PIM field is for metallic components, or MIM. In recent times, that has increased to nearly 90% metallic. Of the 366 firms that currently practice PIM, the majority is located in Asia. The leading countries in terms of PIM were the USA with 106 operations, China with 69 (although expansion is rapid in China), Germany with 41, Japan with 38, Taiwan with 17, Korea with 14, and Switzerland with 12. The number of operations is not necessarily indicative of financial size, since one of the largest MIM facilities is in India, a country which only has five MIM operations, while the USA has the most firms, but they tend to be smaller. Table 1.1 provides a summary of the PIM activities. The USA and China have the most firms while the largest facility is in India.

Table 1.1 Summary statistics on PIM

Percentage of PIM firms in North America Percentage of PIM firms in Europe Percentage of PIM firms in Asia Percentage of PIM firms in rest of world Largest concentration of firms Percentage of firms primarily captive Largest PIM firms | 31 28 37 4 USA, China, Germany, Japan 33 India, USA, Germany, Japan |

Table 1.2 Summary of PIM global sales

Total PIM sales 2010 Total PIM firms Total PIM employment Typical R&D staff Typical profit as % of sales Sales per full-time employee Sales per molding machine Sales per production furnace Percent of firms self-mixing Total installed number of mixers Total installed number of molding machines Total installed number of furnaces Percent of industry using thermal debinding Percent of industry using solvent debinding Percent of industry using catalytic debinding Percent of industry using other debinding Median part size (g) | |

Percentage of PIM firms in North America Percentage of PIM firms in Europe Percentage of PIM firms in Asia Percentage of PIM firms in rest of world Largest concentration of firms Percentage of firms primarily captive Largest PIM firms | 31 28 37 4 USA, China, Germany, Japan 33 India, USA, Germany, Japan |

The PIM field is approximately one-third captive and two-thirds custom production. Example captive operations include ceramic casting core production, orthodontics, surgical tools, medical implants, and firearms.

PIM includes metals, ceramics, and carbides. Together these materials amount to sales for 2010 that reached $1.1 billion, with about $1 billion in metal components. Table 1.2 provides a summary on the global sales performance. In 2011, of the 366 firms practicing PIM, some do multiple materials. Across the industry over 80% of the firms produce metallic components, 20% practice ceramic PIM, 4% practice cemented carbide injection molding, and less than 1% practice composite production (mostly injection-molded silicon carbide that is infiltrated with aluminum to form Al-SiC). Obviously, about 5% of the firms supply a mixture of material types.

Table 1.3 Typical unit manufacturing cell in metal PIM

Mixers Molders Debinding reactors Sintering furnaces Typical number of employees per cell | 1 4 2 2 20 |

Table 1.4 Typical productivity ratios

Mean sales per employee Median employees per molding machine Mean employees per molding machine Mean employees per production furnace Median employees per production furnace Mean sales per molding machine Median sales per molding machine Mean sales per furnace Median sales per furnace Mean sales per mixer (if installed) Median sales per mixer (if installed) Median growth percentage in sales | $125,000 5 4.2 9 6.7 $536,000 $400,000 $976,000 $667,000 $1.8 million $1.0 million 11 |

A MIM or PIM facility basically requires mixing, molding, debinding, and sintering capabilities. Over the years, a typical ratio of these production devices has emerged. Some of the industry unit manufacturing cell ratios are captured in Table 1.3. Note that each device is an integer (one or two or three mixers) so for the mean the value can be noninteger, but for the median only integer values are allowed.

Another metric comes from the productivity, usually measured in terms of sales or per employee. Table 1.4 gives several statistical productivity measures for the global PIM industry. In this table, the employment count is based on full-time equivalent (FTE), since several firms have significant part-time employment. Hence, the typical PIM industry (metals, ceramics, carbides, and composites) seems to be as tabulated.

The key trends in MIM on a global basis are evident by comparing year 2000 with year 2010. For many years, the MIM field sustained compound annual sales growth at 22% per year with a 34% per year increase in the number of operations. In recent years, the growth rates have become more modest and have stabilized near 8% per year in North America, but continue at a 30% per year pace in Asia. Globally the overall average is 14% per year for recent years.

On the basis of some important statistics, here are the changes from year 2000 to year 2010 for MIM:

number of MIM operations decreased 34%;

global sales increased 100%;

employment increased 100%;

installed molding capacity increased 79%;

installed sintering capacity increased 86%.

These statistics indirectly indicate increased concentration of the business into the hands of fewer firms. Although a large number of companies are active in MIM, at any one time some are simply in an evaluation mode, and this was especially true in 2000. These characteristically consist of a small team (two or three people) and one or two molding machines, usually purchased feedstock, and might even rely on toll sintering. After initial exploration, many such efforts are terminated or production is transferred to an outside vendor. This is evident by the decrease in number of MIM firms from 2000 to 2010 while the overall field grew. Today, large actors consist of well over 20 molding machines.

Sales statistics were first gathered in the middle 1980s. Significant growth has produced industry maturation. The metal PIM process is now accepted by several sophisticated customers, such as Bosh, Siemens, Chrysler, Honeywell, Volkswagen, Mercedes Benz, BMW, Chanel, Apple Computer, Pratt and Whitney, Samsung, Texas Instruments, General Electric, Nokia, Motorola, Rolls Royce, Continental, Stryker, LG, Sony, Philips, Seagate, Toshiba, Ford, General Motors, IBM, Hewlett-Packard, Seiko, Citizen, Swatch, and similar firms.

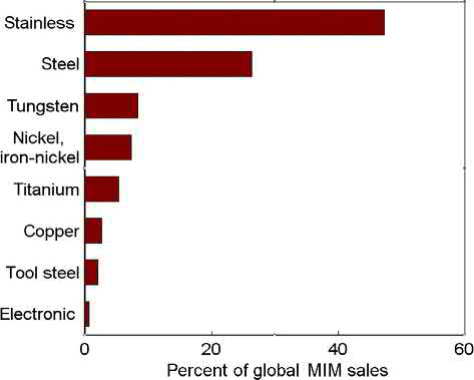

Most of the common engineering materials are available in MIM, but as illustrated in Fig. 1.1, based on sales, stainless steels are dominant. The global material sales (value, not tonnage) are as follows—53% stainless steels, 27% steels, 10% tungsten alloys, 7% iron-nickel alloys (mostly magnetic alloys), 4% titanium alloys, 3% copper, 3% cobalt-chromium, 2% tool steels, 2% nickel alloys (superalloys), and 1% electronic alloys (Kovar and Invar). On a tonnage basis, the stainless steel portion of powder consumption is larger, reaching upwards to 60%–65% of powder consumption, and because of that large consumption the powder price is lower, further fueling the use of stainless steel. Some of the metal powders are much higher priced, such as titanium, so the sales partition based on tonnage versus dollars is skewed due to a wide range in material costs.

Fig. 1.1 MIM sales globally by main material category. This plot is based percent of global sales, while other studies report based on tonnage of powder consumed.

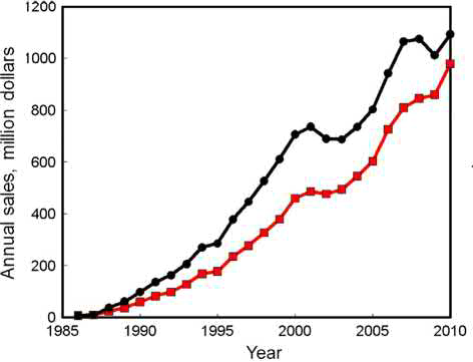

The metal PIM sales for 2010 were in the neighborhood of $1 billion dollars. Independent reports for 2010 give estimates from $955 to $984 million. Some difficulty exists in gathering accurate information since a majority of the firms are privately held and do not make annual reports. Further, currency exchange rates change over the year 8 Handbook of Metal Injection Moldingleading to inaccurate estimates. For 2010, the best estimate on PIM sales is $1.1 billion and MIM sales is $955 million. The PIM estimate for 2009 was $920 million, so PIM grew from 2009 to 2010 by almost 20%, largely in MIM, and was ahead of the general economic recovery.

Fig. 1.2 plots sales growth globally since first recorded at $9 million for 1986. This plot shows that the ceramic business contracted while MIM expanded, largely due to the aerospace slowdowns.

Fig. 1.2 Annual sales, in millions of US dollars, for MIM as the lower curve and all of PIM as the upper curve plotted against year.

Table 1.5 Summary global MIM statistics

2009 total MIM sales 2010 total MIM sales Typical profit as % of sales % MIM sales from self-mixing Installed number of MIM mixers Installed number of MIM molding machines | $860 million $955 million 9 63 290 1450 |

The largest market for MIM has historically been industrial components, including pump housings, solenoids, handles, plumbing fixtures, and fitting. This still amounts to 20% of global sales (more in Japan and less in Europe). This is based on component sales, not number of parts or firms or tons of powder, as is reported in other studies. Automotive components are the second largest market for MIM at 14% of global value (on tonnage basis it is much higher in Europe and lower in North America). Consumer products are the third largest market at 11% of the MIM sales, and these are dominated by Asia (cell phone, consumer, and computer parts). Next are the dental, medical, electronic, and firearm applications, each at 7%–9% of the global MIM product value, with North America being the largest actor. Other contributions come from computers, hand tools, luggage trimmings, cosmetic cases, robots, sporting devices, and watch components.

The statistical profile for MIM firms shows that about half of the global actors are tiny, being under $1 million in annual MIM sales; sometimes these are located as pilot efforts in large companies or more commonly reflecting private ownership. Table 1.5 gives an industry summary for MIM. About 32% of the operations have captive products, but only 18% of the industry sales are primarily captive. Following the Prado Principle, in MIM the largest 20% of firms control 80% of sales. Moreover, the top 10% of MIM firms control over 60% of sales, average $25 million per year turnover and run with 20 or more molding machines and an average of 120 employees. The top 10% of the MIM industry average five employees for each molder, nine people per furnace, turnover $1.5 million per molding machine each year, $3.2 million per furnace each year, and 70% self-mix.

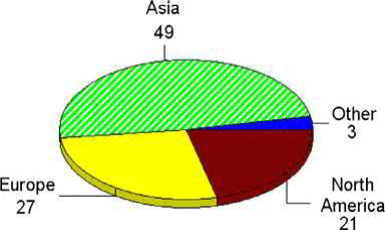

As shown in Fig. 1.3, the primary sales and growth in MIM is in Asia, but the USA remains one of the largest users and producers of ceramic PIM components. Table 1.6 summarizes the regional statistics for PIM in millions of dollars for 2009, the last year where consolidated data are reported. For reference, North American MIM was $186 million in 2009 out of the $316 million total. Of that $32 million was captive MIM. In North America, captive MIM is frequently used for orthodontic brackets and firearms, but is also used for medical applications.

Fig. 1.3 Sales partition based on major geographic region.

Table 1.6 Summary of regional sales for PIM

Region | Total PIM ($ million) |

North America Europe Asia Rest of world Total | 316 293 446 27 1082 |

The valuation of those products is difficult, since the distributed cost (when the bracket is sold to the dentist) is probably $100 million, but the trade cost (bulk internal transfer cost) is more modest. For 2009, in Europe, the dominant captive MIM applications were watches and similar decorative components such as specialty luggage fasteners. In 2009, the Swiss watch industry did about $12 billion in watch sales, at an average transaction of $566 per watch. Not all watches use MIM, but those that do have a typical MIM content in the $1–$8 range, so the 21 million watches would fit with the $32 million captive Europe sales. In Asia, the captive MIM is mostly for the “3Cs”—products for computers, cellular telephones, and consumer electronics—at the assembly houses such as Foxconn.

In prior reports from some of the trade associations, such as the Metal Powder Injection Molding Association in 2006, the medical component sales constituted 36% ofMIM, the automotive component was 14% of sales, and hardware was 20% of sales.

Table 1.7 Market partition by region and application in terms of percent of sales for 2007

Application | North America | Europe | Asia | ROW |

Automotive Consumer Dental Electronics Firearms Hardware Industrial Medical Military Other | 30 0 18 6 6 0 6 34 0 0 | 28 32 14 0 9 0 3 2 1 9 | 18 15 0 41 0 1 14 2 2 5 | 0 0 8 0 66 0 24 1 1 1 |

In the 2007 survey, the MIM market was partitioned as given in Table 1.7 in terms of percentage of sales in each geographic region. More recently, an expanded set of application groups is used to reflect added efforts in sporting, jewelry, hand tools, aerospace, and such. Further, consumer products were separated from watches since watch production was not growing, but uses for latches, eyeglasses, and luggage clasps was growing. Accordingly, the 2010 industry partitioned by application area is given in Table 1.8. This is a combination of number of companies and their relative focus, so a firm that does only dental counts as 1, but a firm that does dental and industrial counts as 0.5 for each, and so on.

Table 1.8 Global market attention based on primary marketing focus for MIM firms in 2011

Field | Percentage |

Aerospace Automotive Casting Cell phone Computer Consumer Cutting Dental Electronic Firearm Hand tool Hardware Household Industrial Jewelry Lighting Medical Military Sporting Telecom Watch Wear | 2 7 2 2 3 10 2 4 10 6 2 2 0 23 1 1 8 4 2 1 2 5 |

This tabulation shows that industrial components (valves, fittings, connectors) are the broadest market focus, followed by consumer (kitchen tools, toothbrush parts, scissors), and electronic components (heat sinks, hermetic packages, connectors). Automotive and medical are fast-growing areas, especially in North America.

When considered in terms of sales value, some of the large markets with fewer actors become evident as tabulated in Table 1.9.

Table 1.9 Percent of global MIM sales for each market segment in 2011

Application field | Percentage |

Aerospace Automotive Casting Cell phone Computer Consumer Cutting Dental Electronic Firearm Hand tool Hardware Household Industrial Jewelry Lighting Medical Military Sporting Telecom Watch Wear | 0 14 0 4 4 11 0 9 9 7 3 1 0 20 1 0<

Contact: Cindy Wang Phone: +86 19916725892 Tel: 0512-55128901 Email: [email protected] Add: No.6 Huxiang Road, Kunshan development Zone, JiangsuShanghai Branch: No. 398 Guiyang Rd, Yangpu District, Shanghai, China |